4. junio 2025 por Sebastian Geißinger

Inteligencia artificial en el sector de seguros

De tendencia a factor estratégico de valor

La inteligencia artificial (IA) hace tiempo que dejó de ser una promesa y se ha convertido en un factor clave de éxito en términos de competitividad, expectativas del cliente y eficiencia. Pero, ¿cómo transformar tecnologías abstractas en valor añadido tangible? ¿Y si no solo los procesos pudieran ser más eficientes, sino también las relaciones con los clientes más personales y sostenibles? La pregunta clave es: ¿Dónde reside exactamente el mayor potencial a lo largo de la cadena de valor y qué tecnologías y casos de uso concretos pueden ampliar realmente el valor para el cliente a largo plazo?

En mi tesis de maestría, me planteé esta cuestión y analicé en profundidad cómo las aseguradoras primarias pueden utilizar la IA para ampliar su propuesta de valor actual para los clientes. Esta publicación ofrece a los responsables de la toma de decisiones y a los ejecutivos una visión práctica de los resultados de esta investigación en las áreas clave de generación de valor: asesoría, ventas, atención al cliente y gestión de siniestros.

El valor se genera en el momento de la verdad: cuando las aseguradoras ofrecen valor real

El seguro nos acompaña durante toda la vida, generalmente en segundo plano, pero está presente en los momentos clave. Cuando queremos protegernos o sufrimos un daño, se hace evidente que lo que realmente importa es la confianza y la fiabilidad. Justo ahí es donde reside el verdadero valor del seguro: en el momento del siniestro.

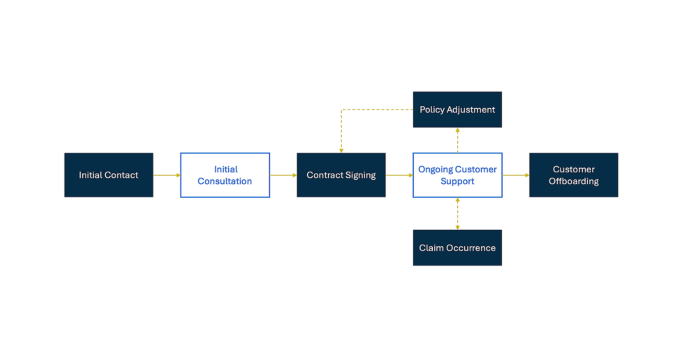

A la vez, los siniestros representan una interfaz central entre ventas, asesoramiento y atención al cliente. Estas áreas acompañan al cliente desde el primer contacto hasta la firma del contrato y la atención continua (ver Figura 1).

El seguro se basa en la confianza, y esta se construye especialmente a través de una atención personalizada. Quien comprende las necesidades del cliente puede no solo ofrecer soluciones a medida, sino también establecer una relación duradera desde el primer contacto.

Figura 1: Pasos del subproceso para ventas, consultoría y gestión de servicios

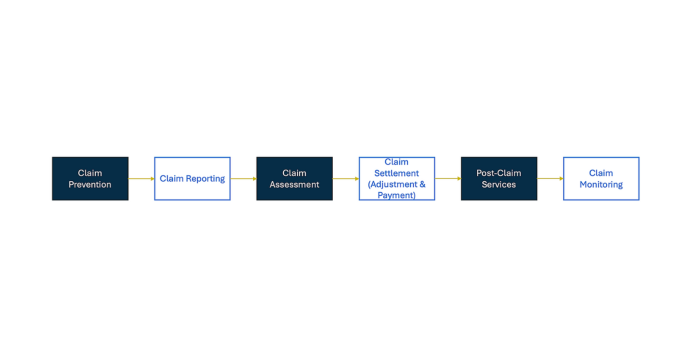

La gestión de siniestros demuestra si una promesa contractual se traduce en un apoyo concreto. Los pasos del proceso –como se muestra en la Figura 2– desde la prevención de siniestros hasta la aceptación, evaluación, liquidación y control de los mismos, determinan cuán orientada al cliente está una aseguradora. ¿La respuesta es rápida? ¿Se proporciona la información de forma transparente? ¿El trato es justo? Estas preguntas moldean la percepción de los clientes y marcan la diferencia entre un simple proveedor y un socio de confianza.

Figura 2: Pasos del subproceso en la gestión de reclamaciones

Consulting, sales, service and claims management are not peripheral areas. They are at the heart of customer perception. This is where what policyholders really feel comes into play: support, security and proximity. And this is precisely where the true core of value creation lies.

Between expectations and efficiency: where insurers need to start today

How can genuine customer experiences not only be preserved in the digital world, but also expanded in a targeted manner? This is precisely where AI unfolds its potential. In the data-driven world of insurance, it has long been part of everyday operations – especially in consulting, sales, service and claims management.

These areas offer ideal conditions: they are close to customers and shape trust and satisfaction. At the same time, many processes are rule-based, but also individual in parts, and are therefore prone to errors and abuse. These are ideal conditions for the targeted use of AI.

AI is proving its worth in consulting, sales and service management. Predictive analytics models identify customer needs at an early stage, chatbots support and advise customers or navigate quickly, efficiently and around the clock through application processes for standardised insurance products.

In claims management, for example, AI is already speeding up processes through image analysis, speech processing and pattern recognition. The result: shorter processing times, more accurate payments, early detection of fraud attempts and, above all, a smooth experience for customers at the moment of truth.

The potential is enormous, but the really exciting question is: Where exactly along the respective value chains does AI offer the greatest potential for substantially expanding the existing value proposition?

To get to the bottom of this question, I spoke specifically with industry experts as part of my research and systematically evaluated their perspectives along the defined value creation areas. The group of experts surveyed consists of strategic consultants from the insurance and IT sectors and predominantly executives from German primary insurance and software development companies.

Sales, consulting and service management

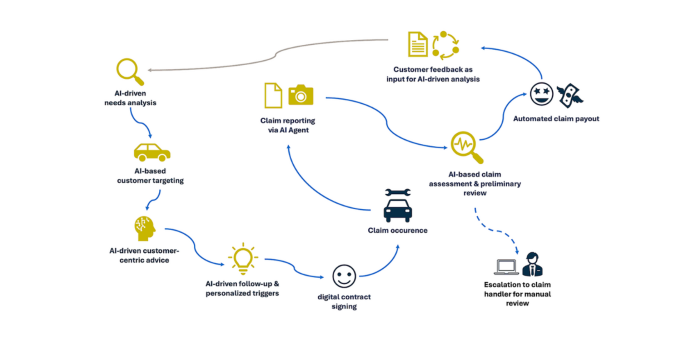

In sales, consulting and service management, the experts surveyed see considerable potential for the targeted use of AI, particularly in the process steps of establishing contact, initial consulting and ongoing support/consulting.

In establishing contact, AI enables targeted, personalised customer engagement via preferred channels through pattern recognition and predictive analytics. This allows customer clusters to be identified so that appropriate content can be placed at the right time (e.g. during discount campaigns). Virtual assistants and AI-supported agents use speech processing to increase efficiency and minimise sources of error – for example, by extracting unstructured data from incoming documents to support administrative tasks.

AI also offers clear added value in initial consultations. Generative AI can use speech-to-text technologies to automatically create conversation logs, reducing administrative effort and creating more space for personal consultation. At the same time, recommendation engines support individual product recommendations, for example in cross-selling and upselling measures or through next-best-action suggestions for individual customers. In the event of dissatisfaction, large language models provide support with empathetic and individually formulated email responses, thus contributing to a positive service experience right from the start of the customer relationship.

AI is used in ongoing support and consulting through voice and speech recognition, natural language processing and facial recognition. This allows callers to be automatically identified and linked to existing customer data, giving consultants an immediate and comprehensive overview. Voice pattern analysis also supports the automated generation of suitable consulting suggestions. Facial recognition can also detect the emotional state of customers and enable situationally appropriate conversation management. In addition, online machine learning processes continuously analyse customer feedback in order to continuously optimise product offerings on a data-driven basis based on successful contract conclusions.

This results in an interactive and customer-focused customer journey with a significantly enhanced service experience. The added value is particularly evident where individual attention, continuous interaction and data-based advice are required.

Claims management

The extended value proposition of AI is also particularly tangible in claims management. According to the experts surveyed, the process steps of claims prevention, claims acceptance and claims assessment offer relevant potential for application.

In claims prevention, AI technologies such as pattern recognition, predictive analytics, and image and video analysis open up new possibilities. For example, satellite images can be automatically evaluated to identify endangered property – such as in potential storm or flood zones – at an early stage. This allows targeted preventive measures to be taken. In addition, customer cluster analyses enable the identification of risk-related behaviour patterns, for example in the automotive sector, where individual telematics tariffs can be integrated into insurance models as preventive add-on modules. This creates clear added value for insurers and customers, in particular through risk-adequate and model-based premium structuring.

AI also plays to its strengths in claims handling. Voice bots and speech-to-text processes automatically transform telephone claims into structured claims files. At the same time, natural language processing ensures that content from emails or forms is automatically recognised, extracted and transferred to the relevant systems. This speeds up processing, minimises queries and improves the overall service experience.

Experts see particular potential in image and video analysis and pattern recognition in the context of claims assessment. Automated classification and object detection algorithms can be used, for example, to accurately identify and assess damage to vehicles or buildings based on submitted images. Vision systems such as cameras or 3D scanners also enable fully automated claims assessment, including the determination of the cause of the accident. In addition, the analysis of patterns from previous claims enables targeted fraud detection. Generative AI also supports automated customer communication, such as for appointment scheduling or feedback during the claims process, significantly increasing both efficiency and service quality.

The analysis shows that AI has the greatest impact in claims management where large amounts of data, standardisable processes and direct customer interfaces come together. The extended value proposition ranges from higher service quality and savings in contribution costs to personalised customer communication and risk minimisation and avoidance.

Recomendación: Comenzar a implementar IA con prioridades claras

Las compañías de seguros deben empezar a utilizar la inteligencia artificial en aquellas áreas donde las altas expectativas de los clientes se cruzan con procesos críticos del negocio. Según expertos del sector, el mayor potencial se encuentra en prevención de pérdidas, evaluación de siniestros, contacto inicial y soporte y asesoramiento continuos.

Es precisamente en estos puntos donde se genera un valor añadido tangible para el cliente: mediante la minimización del riesgo, ahorro en costes de primas, comunicación personalizada y una experiencia de servicio mejorada.

Es fundamental tener en cuenta que el éxito de los proyectos de IA depende, en gran medida, de mantener un enfoque constante en el beneficio para el cliente. La tecnología no debe ser un fin en sí mismo: debe cumplir —y superar— las expectativas del cliente. Además de la viabilidad técnica, las aseguradoras deben considerar también la disponibilidad de datos, las capacidades internas y una clara orientación al valor para el cliente.

Quienes empiecen hoy y generen valor medible estarán sentando las bases para una estrategia de IA a largo plazo y centrada en el cliente. De este modo, la inteligencia artificial se convierte no solo en un motor estratégico de valor, sino también en un verdadero factor diferenciador en un entorno competitivo.

Nuestra propuesta

¿Te gustaría implementar inteligencia artificial generativa en tu compañía de seguros? En adesso te acompañamos en todo el proceso: desde la identificación de casos de uso relevantes y el desarrollo de soluciones personalizadas, hasta su integración en los procesos existentes.

Gracias a nuestro profundo conocimiento del sector asegurador y nuestra excelencia tecnológica, te ayudamos a dar el paso hacia la aseguradora del futuro, impulsada por la IA.